-

Member

LRV - LARVOTTO Gold and Antimony LRV - LARVOTTO Gold and Antimony

I couldn't find LRV on here - is anyone watching this?

I got interested in LRV about 12 months ago after finding they have a small gold exploration prospect in Ohakuri BOP

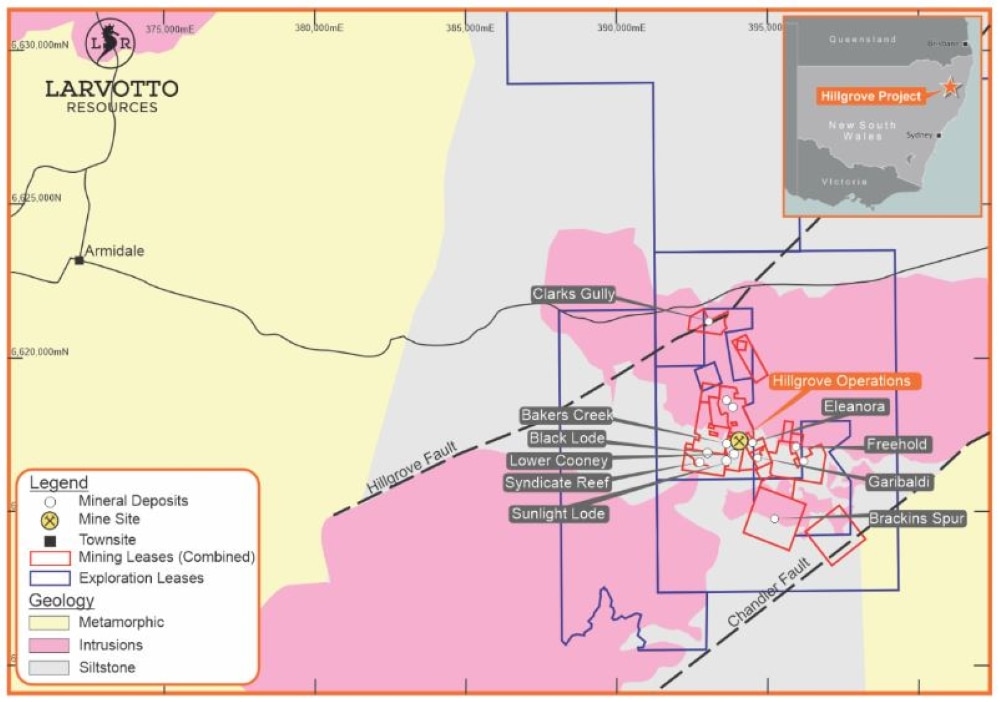

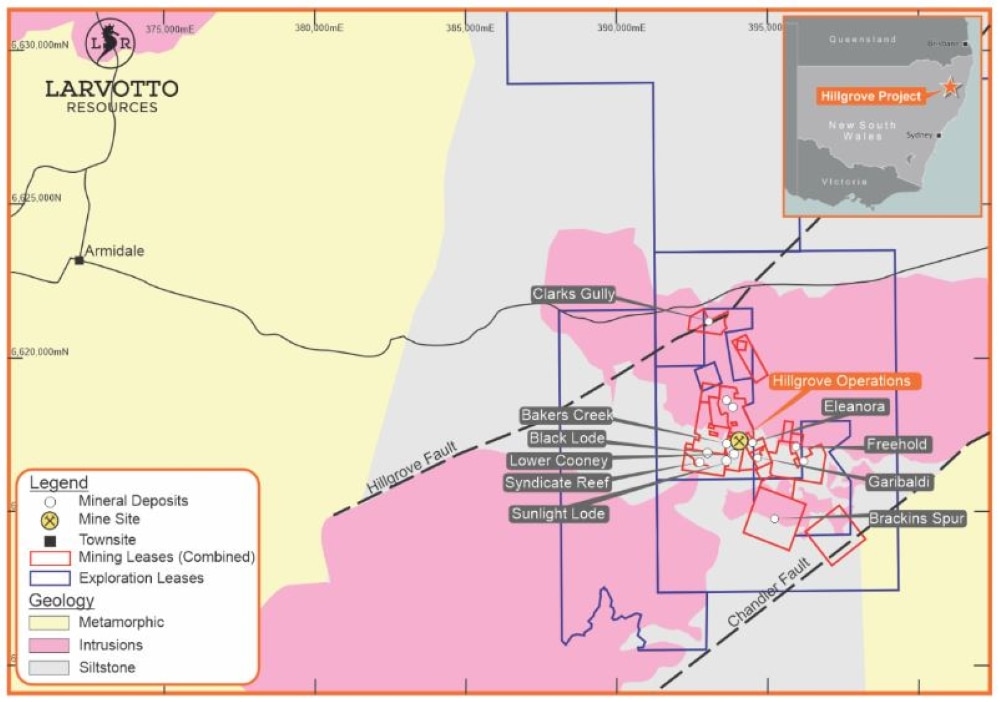

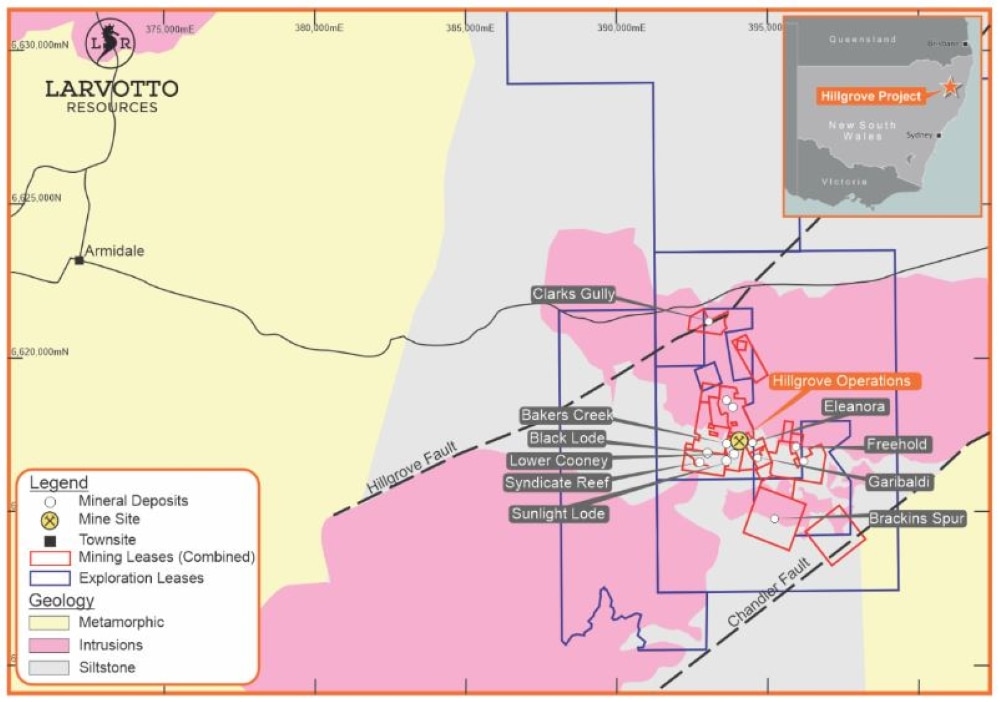

Now am well invested in this for the high grade gold and Antimony at Hillgrove NSW

PFS just released has it at an initial 1.5m ounce gold resource @6gram per ton, 80,000 ounces per year

Seems very well advanced with a good working plant, roading and power already in place with full production planned for early 2026

Record prices for gold and also Antimony with LRV being the largest antimony project in Australia.

02835305.pdf (iress.com.au)

Larvotto Resources (ASX:LRV) - Advancing High-Grade Gold-Antimony Project in NSW, Australia (youtube.com)

-

Originally Posted by freebee

I couldn't find LRV on here - is anyone watching this?

I got interested in LRV about 12 months ago after finding they have a small gold exploration prospect in Ohakuri BOP

Now am well invested in this for the high grade gold and Antimony at Hillgrove NSW

PFS just released has it at an initial 1.5m ounce gold resource @6gram per ton, 80,000 ounces per year

Seems very well advanced with a good working plant, roading and power already in place with full production planned for early 2026

Record prices for gold and also Antimony with LRV being the largest antimony project in Australia.

02835305.pdf (iress.com.au)

Larvotto Resources (ASX:LRV) - Advancing High-Grade Gold-Antimony Project in NSW, Australia (youtube.com)

Hillgroves PFS is well worth the read, imho one of the best near production goldie in Aust atm, little or no funding required with most of the inferstructure required already in place.

-

Have a look at Felix Gold, FXG, they are looking for antimony along with Gold at their Fairbanks prospect. Speculative.

Last edited by airedale; 09-08-2024 at 01:55 PM.

-

Member

Also looks like there is Antimony along with the gold in Reefton ! interesting video:

https://youtu.be/Zyxm8IEBSW4?si=VF1LMY_EOx8GmSsc

-

Member

China antimony ban as juniors of hard rocks rise

China’s antimony ban spurs interest in ASX juniors as hard rock lithium ASX explorers rise and Miramar kicks off drilling at Bangemall.

Cameron Drummond

5 min read

August 16, 2024 - 1:51PM

*

ASX juniors are dancing on China's antimony ban. Pic: Getty Images.

- Chinese antimony ban spurs ASX juniors into gains as trade tensions tighten between global superpowers

- M2R kicks off drilling at Bangemall, which has Norilsk-style mineralisation potential

- Adriatic stares death in the face, rises on ramp-up of Vares silver production

Here are the biggest small cap resources winners in morning trade, Friday, August 16. Prices accurate at time of writing.

In the latest chapter of China banning exports of minerals critical to Western supply chains, the Middle Kingdom has now tightened its grip on antimony, a lightly traded metal with defence applications, adding to previous restrictions on gallium, germanium and graphite.

The ban came in overnight, in a move seen as to stifle US military equipment production, battery tech, semiconductors and other green tech applications.

READ MORE: Shoot across here if you want to know more about China's bans.

Larvotto Resources (ASX:LRV)

(Up on China's news)

Targeting first ore in 2026, LRV's Hillgrove gold-antimony project in NSW has a maiden 606,00oz AuEq reserve, yet it's the antimony that could really be the economic kicker, with 39,000t of the material.

Priced conservatively at US$15,000/t and including the gold endowment, the project is expected to have a capex of $73m and an NPV8 of $157m, according to a PFS.

At spot prices though, the NPV8 sits at $383m and an eye-whopping IRR of 114%.

Those numbers are huge, and China's export restriction announcement could see antimony prices spike considerably.

LRV's Hillgrove is one of the world's top 10 antimony deposits and if into production, would provide an extra supply chain avenue against China's dominant position as its number 1 exporter.

A definitive feasibility study is underway as exploration looks to increase existing resources, which include metallurgical testwork also being conducted to de-risk and further increase economic processing margins.

Shares in the explorer have spiked on the news, up 32% to trade at 16c.

-

Originally Posted by freebee

China antimony ban as juniors of hard rocks rise

[FONT="]China’s antimony ban spurs interest in ASX juniors as hard rock lithium ASX explorers rise and Miramar kicks off drilling at Bangemall.

[FONT="]Cameron Drummond[/FONT][FONT="]

5 min read

August 16, 2024 - 1:51PM

*[/FONT]

[/FONT]

ASX juniors are dancing on China's antimony ban. Pic: Getty Images.

- Chinese antimony ban spurs ASX juniors into gains as trade tensions tighten between global superpowers

- M2R kicks off drilling at Bangemall, which has Norilsk-style mineralisation potential

- Adriatic stares death in the face, rises on ramp-up of Vares silver production

Here are the biggest small cap resources winners in morning trade, Friday, August 16. Prices accurate at time of writing.

In the latest chapter of China banning exports of minerals critical to Western supply chains, the Middle Kingdom has now tightened its grip on antimony, a lightly traded metal with defence applications, adding to previous restrictions on gallium, germanium and graphite.

The ban came in overnight, in a move seen as to stifle US military equipment production, battery tech, semiconductors and other green tech applications.

READ MORE: Shoot across here if you want to know more about China's bans.

Larvotto Resources (ASX:LRV)

(Up on China's news)

Targeting first ore in 2026, LRV's Hillgrove gold-antimony project in NSW has a maiden 606,00oz AuEq reserve, yet it's the antimony that could really be the economic kicker, with 39,000t of the material.

Priced conservatively at US$15,000/t and including the gold endowment, the project is expected to have a capex of $73m and an NPV8 of $157m, according to a PFS.

At spot prices though, the NPV8 sits at $383m and an eye-whopping IRR of 114%.

Those numbers are huge, and China's export restriction announcement could see antimony prices spike considerably.

LRV's Hillgrove is one of the world's top 10 antimony deposits and if into production, would provide an extra supply chain avenue against China's dominant position as its number 1 exporter.

A definitive feasibility study is underway as exploration looks to increase existing resources, which include metallurgical testwork also being conducted to de-risk and further increase economic processing margins.

Shares in the explorer have spiked on the news, up 32% to trade at 16c.

WEH !! market catching on to LRV's hidden value now, up 30+% today with much much more to come .

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

-

Forum Rules

|

|

Reply With Quote

Reply With Quote

Bookmarks